does portland oregon have sales tax

Average Local State Sales Tax. Oregon doesnt have a general sales or usetransaction tax.

There are no local taxes beyond the state rate.

. The sales tax in Portland Oregon is. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. However Oregon does have a vehicle use tax or a vehicle privilege tax that applies to new vehicles purchased either in.

This rate is made up of a 65 state sales tax and a 10 local sales tax. The state of Oregon does not have sales tax. While many other states allow counties and other localities to collect a local option sales tax Oregon does not.

Do any cities in Oregon have sales tax. Portland which belongs to the state of Oregon doesnt impose a sales tax. The sales tax in Portland Oregon is currently 75.

Complete Edit or Print Tax Forms Instantly. Its just that in 1990 we chose to cut property taxes and not replace. The sales tax is 5 in Juneau while Anchorage and Fairbanks do not have sales taxes and the average rate statewide for municipalities is 176.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The minimum combined 2022 sales tax rate for Portland Oregon is. 2022 Oregon state sales tax.

Maximum Possible Sales Tax. Oregon imposes new local income taxes for Portland Metro and Multnomah County. Ad Access Tax Forms.

By Eduardo Peters August 15 2022 August 15 2022 Joe Gilliam president of the Northwest Grocery Association said Since. Instead the corporate activity tax is applied to businesses based on their overall sales revenue. On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers The tax applies to revenue from all retail sales of.

The average cumulative sales tax rate in Portland Oregon is 0. Is Oregon a no sales tax state. The sales tax in Portland Oregon is currently 75.

Oregon is one of 5 states that does not impose any sales tax on purchases made in the. Does Oregon Have Sales Tax On Groceries. The tax must be paid.

Oregon is one of. Sales Tax Handbook Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NA. The fact is that we did generate enough revenue from these two sources to make up for not having a sales tax.

However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. This includes the rates on the state county city and special levels. The sales tax in Portland Oregon is currently 75.

The Oregon sales tax rate is currently. Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive. Did South Dakota v.

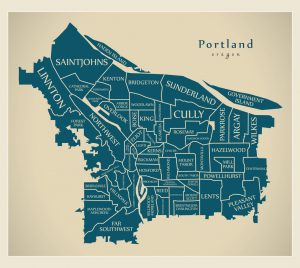

The system applies both to local and state levels meaning you wont be levied for. Portlands local sales tax jurisdictions are made up. Exact tax amount may vary for different items.

Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state. Portland has parts of it located within. Oregon doesnt have a general sales tax or a transaction tax.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Does Portland have sales taxes. This is the total of state county and city sales tax rates.

While many other states allow counties and other localities to collect a local option sales tax Oregon does. The state sales tax rate in Oregon is 0000. Even though there may be drawbacks the five states that dont have sales tax are Alaska Delaware Montana New Hampshire and Oregon.

Doing Business In Portland Unbutton That Jacket Bbc Worklife

News Events The City Of Portland Oregon

Tax Free Shopping Oregon S Tualatin Valley

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Portland Property Tax How Does It Compare To Other Major Cities

New Oregon Tax Aims To Succeed After Long History Of Sales Tax Failures Opb

Can A Ceo Tax Strike A Blow To Inequality In Portland The Answer Is Elusive

Portland Property Tax To Increase Slightly Ke Andrews

Portland Oregon Learn About Life In And Around Portland Or Usa Pela

Portland Oregon Taxes Big Businesses To Fund Clean Energy Jobs

Oregon Sales Tax Rates By City County 2022

Portland Oregon Targets Large Retailers With New Gross Receipts Tax

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Navigate Portland S Gross Receipts Tax On Large Retailers

Do Oregon Residents Pay A Sales Tax On Cars In Washington

Portland Voters Put A 1 Tax On Large Retailers But Some Consumers Are Paying It Too Oregonlive Com

State Sales Tax Rates 2022 Avalara

States With No Sales Tax Kiplinger

Where Do My City Of Portland Business Tax Dollars Go News Projects The City Of Portland Oregon